Loading

Get Irs Form 9898

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 9898 online

Filling out the Irs Form 9898 online can be a straightforward process when you have clear guidance. This guide will help you understand each section of the form and provide detailed instructions for completing it effectively.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

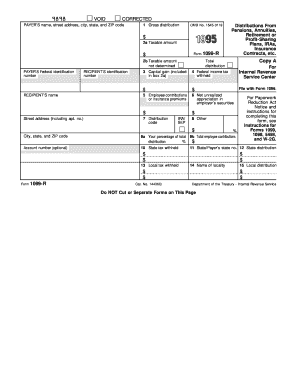

- Begin by entering the payer’s name, street address, city, state, and ZIP code in the designated fields. Ensure that this information is accurate as it identifies the source of the payments reported.

- In box 1, input the gross distribution amount you have received during the year. This amount indicates the total distributions from pensions, annuities, and other relevant sources.

- Next, fill out box 2a for the taxable amount of the distribution. If you cannot determine the taxable amount, check the 'taxable amount not determined' box in 2b.

- If applicable, include any capital gains in box 3. This amount should represent any included capital gains within the distribution.

- In box 4, specify the amount of federal income tax that has been withheld from the distribution. This information is essential for tax reporting.

- Continue to boxes 5 and 6 to enter any employee contributions or insurance premiums and the net unrealized appreciation in employer’s securities, if relevant.

- In box 7, use the distribution code that applies to your situation. This code indicates the nature of the distribution.

- Complete the remaining boxes (8 through 15) as applicable, providing information on state taxes withheld and local distributions, if any.

- After reviewing all entered information for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your Irs Form 9898 online today for efficient and accurate reporting.

The W-8BEN form is completed by non-US individuals or entities who receive income from US sources and wish to claim tax treaty benefits. This form is crucial for avoiding higher withholding taxes. If you need help determining if you should fill out this form, platforms like US Legal Forms can provide valuable advice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.