Loading

Get Acc1 Kenton County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Acc1 Kenton County online

Completing the Acc1 Kenton County form online is a straightforward process. This guide offers step-by-step instructions to assist you in accurately filling out the necessary information, ensuring a smooth submission.

Follow the steps to fill out the Acc1 Kenton County form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will give you access to the necessary fields and sections required for completion.

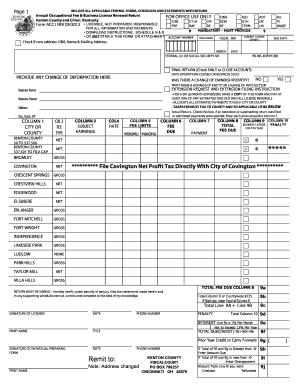

- Review the top section of the form that states, 'FOR OFFICE USE ONLY'. Ensure that you are the licensee responsible for all information and payments as indicated.

- Fill in your account number in the designated field. Check the box if there is a new address for your business, and provide your Doing Business As (DBA) name, contact name, and mailing address.

- Specify the fiscal year ended by entering the month and year in the appropriate fields, alongside the date when your current license expires and the due date for the form submission.

- Input your Federal Identification number or Social Security number in the corresponding field, along with the Federal Business Activity Code that applies to your business.

- Indicate whether this is a final return by checking the box if you are closing your account. If applicable, specify the date when operations ceased or the business was sold.

- In the change of information section, provide details regarding any changes in ownership or entity. Select 'Yes' or 'No', and print the name and address of the entity if there has been a change.

- Complete the sections regarding estimated fees, total fee calculations, and any penalties. Ensure that all amounts are filled out accurately and allocated correctly for each city or county.

- Sign and date the form as required. Ensure that your signature is in the 'SIGNATURE OF LICENSEE' section and print your name underneath it.

- Upon final review, you may save changes, download the completed form, print it for your records, or share it by submitting it as required.

Start filling out your Acc1 Kenton County form online today for a hassle-free experience.

To calculate the withholding tax in Acc1 Kenton County, you will need to refer to the current tax rate, the employee's income, and any allowances claimed on their W-4 form. This calculation process can be facilitated using payroll software or guidance from the Kentucky Department of Revenue. Implementing accurate calculations helps prevent underpayment or overpayment of taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.