Loading

Get Irmaaa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irmaaa online

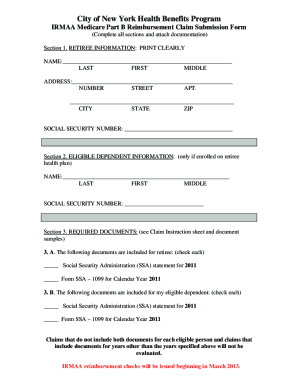

Filing for the Irmaaa reimbursement can be an essential step for those who paid higher Medicare Part B premiums based on their income. This guide will provide you with a clear and structured approach to successfully complete the Irmaaa claim form online.

Follow the steps to complete the Irmaaa claim form online.

- Click ‘Get Form’ button to obtain the Irmaaa claim form and open it in a suitable online editor.

- Begin with Section 1 labeled 'Retiree Information'. Here, print your full name, address, and Social Security number clearly in the designated fields.

- If you have an eligible dependent enrolled in your health plan, complete Section 2 titled 'Eligible Dependent Information' by filling in their full name and Social Security number.

- In Section 3, review the 'Required Documents' checklist. Ensure you have both the Social Security Administration (SSA) statement and Form SSA-1099 for the calendar year 2011 for yourself and your eligible dependent. Check each box next to the items you are submitting.

- Once you have completed all sections and included the required documentation, review your information for accuracy. Save your changes and ensure you download a digital copy of your completed form.

- Print out a hard copy of the form and the attached documents. Make sure to keep a copy for your records.

- Mail your completed claim form and required documentation to the City of New York at the specified address: City of New York, Office of Labor Relations, Health Benefits Program, 40 Rector Street, 3rd Floor, New York, NY 10006, Attention: IRMAA.

Complete your IRMAA reimbursement claim online today to ensure you receive the funds you are eligible for.

While the exact Irmaaa brackets for 2025 have not yet been officially announced, they typically reflect slight adjustments from previous years. These changes are influenced by economic factors and inflation rates. To stay ahead, keep an eye on updates related to Medicare policies. Planning for these anticipated changes can significantly benefit your overall financial strategy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.