Loading

Get Lacers Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lacers rollover form online

Filling out the Lacers rollover form online is a crucial step in managing your retirement funds effectively. This guide provides clear instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the Lacers rollover form online

- Firstly, press the ‘Get Form’ button to access the Lacers rollover form and open it in your editing tool.

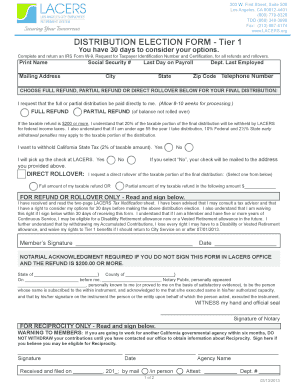

- Begin by entering your full name and Social Security number in the designated fields to identify yourself.

- Indicate your last day on payroll and the department where you were last employed, as this information is essential for your records.

- Provide your mailing address, including city, state, and zip code. Ensure the telephone number is accurate in case follow-up contact is necessary.

- Choose either a full refund, partial refund, or direct rollover for your final distribution. Read the accompanying information regarding tax implications for accurate decision-making.

- If you opted for a direct rollover, specify whether you want the full or partial taxable amount for your final distribution. Be sure to fill in the exact amount if you choose a partial rollover.

- Read and sign the acknowledgment regarding the receipt of the LACERS tax notification and your understanding of the implications of your election, including potential penalties and loss of benefits.

- If necessary, complete the notarial acknowledgment section if you are not signing in the LACERS office and if your refund amount is $200 or more.

- If you believe you may be eligible for reciprocity with another California governmental agency, sign the corresponding section.

- Finally, review all the information for accuracy, then save your changes, download a copy, print it if needed, or share the completed form as required.

Complete your Lacers rollover form online today to ensure your retirement funds are managed effectively.

The primary purpose of a rollover is to maintain the tax-advantaged status of your retirement savings when changing jobs or reorganizing your financial plan. It allows you to move your funds to a more suitable account without incurring taxes or penalties. Using the Lacers Rollover Form ensures that you follow the correct procedures to achieve a successful rollover.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.