Loading

Get Internal Revenue Bulletin: 2012-33internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Internal Revenue Bulletin: 2012-33Internal Revenue Service online

This guide provides a comprehensive overview of how to accurately complete the Internal Revenue Bulletin: 2012-33Internal Revenue Service form online. By following these instructions, users can ensure that their applications are filled out correctly and submitted in a timely manner.

Follow the steps to effectively fill out the Internal Revenue Bulletin: 2012-33Internal Revenue Service online.

- Click the ‘Get Form’ button to retrieve the online version of the form and access it in your preferred editing application.

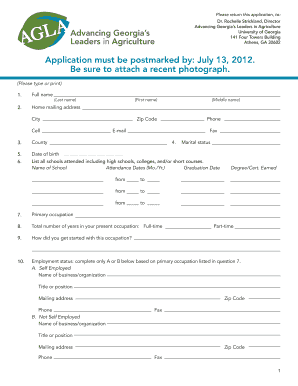

- Type or print your full name in the designated section, ensuring to include your last name, first name, and middle name as applicable.

- Provide your home mailing address, including the city, zip code, phone number, and email address. Ensure that the information is accurate.

- Indicate your county and marital status as required.

- Enter your date of birth in the specified format (month/day/year).

- List all schools you have attended, along with attendance dates and graduation dates. Include any degrees or certifications earned.

- State your primary occupation and note the total number of years you have been in that occupation.

- Explain how you got started in your occupation with a brief description.

- Provide your employment status. Report if you are self-employed or not and fill out the relevant section accordingly.

- For self-employed individuals, answer the series of questions in Part A to provide details about your business and responsibilities.

- For those not self-employed, complete Part B with information about your employer, including your position and number of employees.

- List any memberships and offices held in various organizations, including college and professional affiliations.

- Describe up to two projects or programs where you held a leadership role, detailing your contributions and initiatives.

- Record any awards or honors that you have received from various organizations or grantors.

- Indicate your reading habits regarding newspapers, books, and magazines over the past year.

- Confirm whether you have computer access at home or in the office and detail your internet connection type if applicable.

- List any mobile digital devices you currently use.

- Identify progressive community or state leaders who inspire you, explaining why you chose them.

- Provide three business and/or personal references, avoiding family members in your selection.

- In up to 200 words, outline what you perceive to be the most pressing issues facing your community, state, or nation.

- Articulate your reasons for wanting to participate in the Advancing Georgia's Leaders in Agriculture program.

- Include any other personal or professional information you believe is relevant for consideration.

- For the spouse/significant other section, repeat similar steps as above, ensuring to fill out all required fields.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Complete your application for the Internal Revenue Bulletin: 2012-33Internal Revenue Service online today!

To fax an IRS notice response, first check the notice for specific fax numbers related to your case. Each correspondence often includes instructions tailored to the situation. If you need a structured approach to managing such communications, the resources provided by the Internal Revenue Bulletin: 2012-33Internal Revenue Service can guide you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.