Get Michigan Department Of Treasury Form 4632

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Michigan Department Of Treasury Form 4632 online

This guide provides clear and comprehensive instructions for completing the Michigan Department Of Treasury Form 4632 online. Whether you are a first-time user or familiar with the process, this resource aims to simplify your experience with the Principal Residence Exemption Audit Questionnaire.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

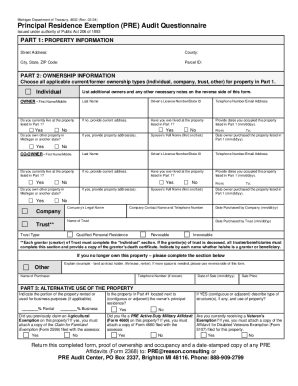

- Begin by entering the property information in Part 1. Fill in the street address, county, city, state, ZIP code, and parcel ID for the property in question.

- Proceed to Part 2 for ownership information. Indicate all applicable options regarding property ownership. You must provide proof of ownership, such as a deed or land contract.

- For ownership by a company or trust, enter the company’s legal name and the purchase date. If applicable, input the trust's name and type, along with the date it was purchased.

- In the individual section, enter the owner’s first name, middle name, last name, driver's license number, and telephone number. Indicate if they currently live at the property, and if not, provide their current address.

- If the owner has ever lived at the property, provide the occupation dates. Additionally, list any other properties owned in Michigan or elsewhere, if applicable.

- Add details for co-owners using the same format as for the primary owner. Ensure all fields are completed accurately.

- Move on to Part 3, where you will indicate the portion of the property used for rental or business purposes. Provide additional required details regarding exemptions if they apply.

- After filling in all relevant sections of the form, review your answers for accuracy.

- Once you have verified that all information is correct, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your Michigan Department Of Treasury Form 4632 online today to ensure your property compliance.

The easiest tax form often depends on your specific situation, but many people find that the Michigan Department of Treasury Form 4632 is straightforward for claiming various tax exemptions. It is designed to simplify the process of reporting and clarifying your tax status. For even more convenience, you can use tools available on sites like US Legal Forms to ensure you fill it out correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.