Loading

Get 593b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 593b online

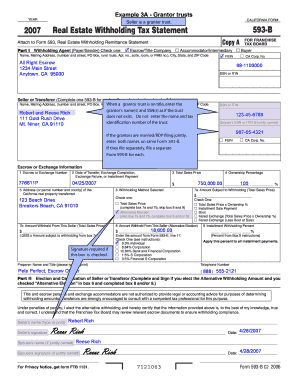

Filling out the 593b form online can be an essential step in ensuring proper compliance with real estate withholding tax regulations. This guide provides clear, step-by-step instructions to assist users in accurately completing the form and submitting it with ease.

Follow the steps to fill out the 593b form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form's sections carefully before starting. The form is divided into parts that require specific information about the seller, buyer, and transaction details.

- In Part I, enter the name, mailing address, and identifying number (such as SSN or ITIN) for the seller or transferor. If there is more than one seller, complete a separate 593b for additional sellers.

- Complete the escrow or exchange information, including the escrow number and the date of the transaction. Ensure that you accurately enter the address or parcel number of the property being transferred.

- Indicate the withholding method selected by checking the appropriate box. You must fill out the total sales price and the amount subject to withholding, as specified in the relevant boxes.

- If you elected for an alternative withholding amount, complete boxes 8 and/or 9 with the relevant information regarding installment payments or failed exchanges.

- Provide the name and contact information of the preparer in Part II. Ensure that they understand the responsibilities and limitations regarding tax advice.

- Sign and date the form. Ensure that both sellers sign if the property is jointly owned. The signatures confirm that the information provided is accurate and that you elect the alternative withholding if applicable.

- Finally, review all entries for accuracy, save changes to the completed form, download it, or print it as necessary. You may also choose to share it with relevant parties.

Start filling out the 593b form online today to ensure timely and accurate submission.

Exemptions from California withholding may apply to specific categories, including certain types of sales or transactions involving resident sellers. For example, if the seller is a California resident, withholding tax does not generally apply. To fully understand your exemptions, take advantage of resources like USLegalForms, where you can find comprehensive information tailored to your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.