Get 1040a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

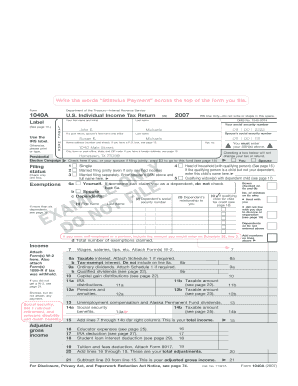

How to fill out the 1040A online

Filling out the 1040A tax form online can seem daunting, but this guide will walk you through each step in a clear and supportive manner. Whether you are new to filing taxes or seeking a refresher, understanding the components of the 1040A will help you complete it efficiently.

Follow the steps to successfully complete the 1040A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the label section, including your first name, last name, and social security number. If filing jointly, include your spouse’s information as well.

- Indicate your filing status by checking the appropriate box. Choose from single, married filing jointly, or head of household as applicable.

- Input the number of exemptions you are claiming. This includes yourself, your spouse, and any dependents.

- Next, report your income by entering wages from Form W-2, interest, dividends, and any other applicable income sources. Make sure to follow the instructions for any additional forms required.

- Calculate your adjusted gross income by subtracting any deductions from your total income. Enter this amount in the designated area.

- Proceed to determine your taxable income. Subtract your standard deduction from your adjusted gross income, and ensure the result is accurate.

- Calculate your total tax and applicable credits, such as those for children or education. List these accurately in the designated sections.

- Finally, review all entered information for accuracy. You can then choose to save your changes, download, print, or share the form.

Complete your tax filing smoothly by filling out the 1040A online.

To fill out your tax exemption form, first confirm your eligibility to avoid paying certain taxes. Then, carefully complete the form by providing all required personal and financial information. The exemption process can be complex, but the 1040a form can help simplify reporting your situation. For further assistance, uslegalforms provides resources that guide you through completing these forms accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.