Get Asu Untaxed Income Verification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Asu Untaxed Income Verification Form online

Filling out the Asu Untaxed Income Verification Form is an essential step in ensuring that your financial assistance application is complete. This guide provides comprehensive instructions on how to accurately fill out the form online, ensuring that you provide all necessary information for processing.

Follow the steps to complete the Asu Untaxed Income Verification Form online

- Press the ‘Get Form’ button to access the Asu Untaxed Income Verification Form and open it in your preferred editor.

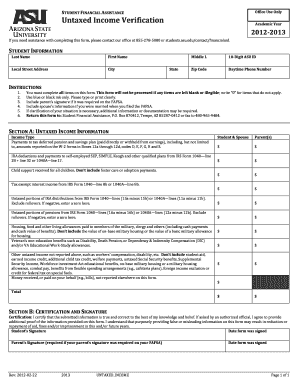

- Begin by entering your student information at the top of the form. Fill in your last name, first name, middle initial (if applicable), local street address, city, state, zip code, 10-digit ASU ID, and daytime phone number.

- Proceed to Section A: Untaxed Income Information. Carefully report your untaxed income by identifying each applicable type, entering the amounts for yourself and your spouse, if married, as well as your parents' information.

- Ensure that you clarify and fill in each income type that applies to you, providing zeros for items that do not apply to avoid leaving any fields blank. Include income from pension plans, IRA distributions, child support, and any other relevant untaxed income.

- Move to Section B: Certification and Signature. Read the certification statement carefully to understand your obligations regarding the accuracy of the information provided.

- Complete the signature section by signing and dating the form. If required, ensure your parent also signs the form. Double-check that all parts are filled in clearly and accurately.

- Once everything is complete, save your changes, and then prepare to download, print, or share the form as needed to submit it to Student Financial Assistance.

Complete your Asu Untaxed Income Verification Form online today to ensure your financial assistance application is processed efficiently.

Filing for the foreign earned income exclusion involves submitting IRS Form 2555 along with your Form 1040 during tax season. Ensure your application is precise and backed with the necessary documents to substantiate your income claims. This attention to detail is also paramount when completing the ASU Untaxed Income Verification Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.