Loading

Get Ms Dept Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS Department of Revenue online

Filling out the MS Department of Revenue form can seem daunting, but with this guide, you will be equipped to complete it accurately and efficiently. Each section is outlined to help you navigate the necessary fields and ensure compliance with state requirements.

Follow the steps to complete your MS Department of Revenue form.

- Press the ‘Get Form’ button to access the form and open it in the designated editor.

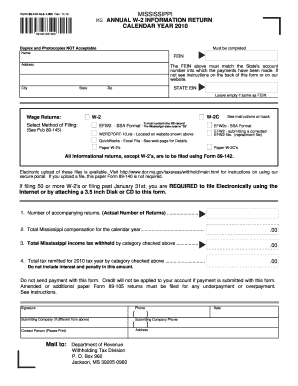

- Enter your name and Federal Employer Identification Number (FEIN) in the specified fields. Ensure that the FEIN matches the state’s account number for payment processing.

- Fill in your mailing address, including city, state, and zip code. If you have a separate State EIN, enter it in the designated field.

- Select the method of filing you intend to use. Options include various electronic formats such as EFW2 or paper W-2 forms.

- Complete the Wage Returns section by indicating the number of accompanying returns and the total Mississippi compensation for the calendar year.

- Input the total Mississippi income tax withheld for the year, leaving it blank if none was withheld.

- Fill in the total tax remitted for the year, ensuring not to include any interest or penalties.

- Provide your contact information, including your phone number and the name of a contact person if applicable.

- Sign and date the form, ensuring that the submission is complete and accurate before sending it to the Department of Revenue.

- Finally, you can choose to save your changes, download, print, or share the completed form as needed.

Get started on your form submission online today!

Related links form

To obtain a Mississippi tax ID number, you will need to apply through the Mississippi Department of Revenue's official channels. The application process can be completed online or by submitting a physical form. Having your tax ID number will facilitate your interactions with the state's tax systems.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.