Loading

Get Tsp U 1 C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tsp U 1 C online

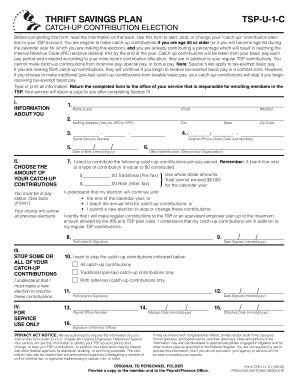

The Tsp U 1 C form allows individuals aged 50 and older to start, stop, or change their catch-up contributions to their Thrift Savings Plan account. This guide provides clear instructions on completing the form online, ensuring you can manage your retirement contributions effectively.

Follow the steps to complete the Tsp U 1 C form online.

- Click ‘Get Form’ button to access the Tsp U 1 C and open it for editing.

- In Section I, provide your personal information, including your name, mailing address, social security number, daytime phone number, state, and date of birth.

- In Section II, choose the amount of your catch-up contributions per pay period. Ensure to input whole dollar amounts, indicating separate amounts for traditional (pre-tax) and Roth (after-tax) contributions. Remember, your total contributions cannot exceed $5,500 for the calendar year.

- Sign and date the form to certify your contributions, acknowledging your ability to make regular contributions up to the allowed maximum.

- If you need to stop any catch-up contributions, complete Section III by indicating which contributions to stop, and sign it.

- Once all sections are complete, save the changes, download, print, or share the form as needed. Ensure to return it to the appropriate service office responsible for TSP enrollment.

Start filling out your Tsp U 1 C online today to ensure your retirement contributions are managed effectively.

As a reminder, the IRS announced the new limits for contributions to TSP in 2023. The maximum amount a participant under age 50 can contribute is $22,500. The catch up for investors over age 50 was increased to $7500 for 2023. The total contribution for employees over age 50 for 2023 is $30,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.