Loading

Get Sd 54 403b Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sd 54 403b Form online

Completing the Sd 54 403b Form online is a straightforward process that allows you to manage your retirement contributions efficiently. This guide provides step-by-step instructions to help you navigate through each section of the form with ease.

Follow the steps to complete the Sd 54 403b Form online

- Press the 'Get Form' button to access the Sd 54 403b Form and open it in your preferred online editor.

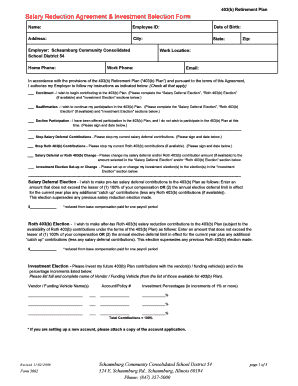

- Fill in your personal details in the form, including your name, employee ID, date of birth, address, city, state, zip code, home phone, work location, work phone, and email.

- Select your participation choice by checking the appropriate box: Enrollment, Reaffirmation, Decline Participation, Stop Salary Deferral Contributions, Stop Roth 403(b) Contributions, Salary Deferral or Roth 403(b) Change, or Investment Election Set-up or Change.

- In the Salary Deferral Election section, enter the amount you wish to contribute as pre-tax salary deferrals. Ensure this amount does not exceed the limits specified.

- If applicable, in the Roth 403(b) Election section, enter the amount you wish to contribute as after-tax Roth contributions, adhering to the specified limits.

- In the Investment Election section, list the vendor or funding vehicle names and corresponding account/policy numbers alongside the percentage allocations, ensuring the total contributions equal 100%.

- If you have contributed to other retirement plans during the calendar year, select 'Yes' or 'No' and, if applicable, enter the total amount contributed.

- After reviewing all the information, sign and date the form to certify the accuracy of the details provided.

- Save your changes, download the filled form, or choose to print or share it as needed.

Complete your Sd 54 403b Form online today to manage your retirement savings effectively!

The 5 year rule for a 403b plan states that if you take a distribution from the plan, it must meet specific guidelines if you are under age 59½. This rule helps determine whether you'll face penalties during early withdrawals. Understanding this rule in conjunction with the Sd 54 403b Form is essential for tax planning. Always consult a financial advisor for personalized guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.