Loading

Get Kansas K 4 Form Fill Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas K 4 Form Fill Online

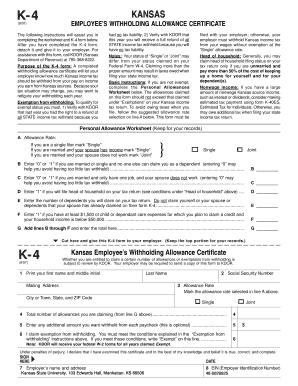

The Kansas K 4 Form Fill Online is a crucial document used to inform your employer about your withholding allowances for state income tax. Completing this form accurately ensures that the correct amount of tax is withheld from your paychecks, reflecting your financial circumstances and obligations.

Follow the steps to successfully complete your Kansas K 4 Form Fill Online.

- Click ‘Get Form’ button to obtain the Kansas K 4 form and open it for editing.

- Begin by entering your personal information in the spaces provided. Fill in your first name, middle initial, and last name, followed by your mailing address, city or town, state, and ZIP code.

- Next, enter your Social Security number in the appropriate field. This number is essential for your employer to process the withholding accurately.

- On the form, you will find the section labeled 'Allowance Rate.' Based on your situation, mark the option that corresponds to your filing status — either 'Single' or 'Joint'.

- Subsequently, determine and input the total number of allowances you are claiming as calculated from the Personal Allowance Worksheet. Enter this total in the designated box.

- If you wish to have an additional amount withheld from each paycheck, you can specify this amount in the next field. This step is optional, so only fill it out if you desire extra withholding.

- Exemption from withholding can be claimed if you meet the conditions listed in the instructions section. If eligible, write 'Exempt' in the provided line. Ensure you understand the implications of claiming this status.

- Finally, review all the entered information for accuracy. Sign and date the form to validate it, and then detach the completed portion to submit to your employer.

- Once you have filled out the form, you can save your changes, download, print, or share the completed form as necessary.

Complete your Kansas K 4 Form Fill Online efficiently and ensure your tax withholding is accurately managed.

Yes, Kansas offers an e-file form for electronic tax submissions. You can utilize the uslegalforms platform to access the Kansas K 4 Form Fill Online and submit it electronically. This option streamlines your tax-filing experience, ensuring you meet deadlines and reduce paperwork.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.