Loading

Get Form 1021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1021 online

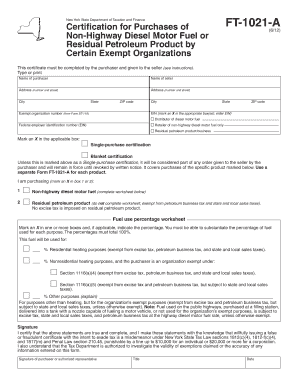

Filling out Form 1021 online allows exempt organizations to certify their purchases of non-highway diesel motor fuel or residual petroleum products. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Form 1021 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the name of the purchaser in the designated field. Ensure that the name accurately reflects the organization completing the certification.

- Provide the name and address of the seller, including the street address, city, state, and ZIP code.

- Input the exempt organization number obtained from Form ST-119, along with the address information for the seller.

- Indicate the employer identification number (EIN) by marking an X in the appropriate box, identifying whether the seller is a distributor of diesel motor fuel or a retailer specifically for non-highway diesel motor fuel.

- Select the type of certification by marking an X in the box for either single-purchase certification or blanket certification.

- Specify the type of fuel being purchased by marking an X in either box 1 for non-highway diesel motor fuel or box 2 for residual petroleum product.

- Complete the fuel use percentage worksheet by marking an X for the purposes of fuel use (residential heating, nonresidential heating, or other purposes) and indicating the respective percentage for each purpose, ensuring the total equals 100%.

- Sign the form, certifying that the entered information is true and complete. Include the signature of the purchaser or an authorized representative, their title, and the date of signing.

- After completing all fields, review the form for accuracy. You may save changes, download, print, or share the form as needed.

Complete your Form 1021 online today to ensure compliance and benefit from your exempt status.

The IRS does not have a specific form for inheritance tax because, in most cases, inheritances are not taxed as income. However, if the estate exceeds a certain threshold, the executor may need to file a Form 1021 to report distributions and any associated tax obligations. Understanding the applicable tax laws can help beneficiaries navigate their responsibilities effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.