Get Employees Statement Of Nonresidence In Pennsylvania Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employees Statement Of Nonresidence In Pennsylvania Fillable Form online

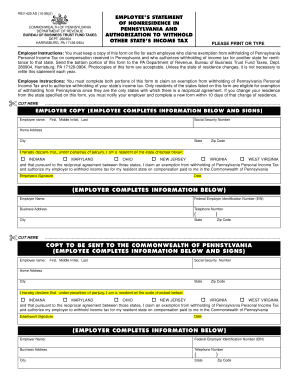

Completing the Employees Statement Of Nonresidence In Pennsylvania Fillable Form is a vital process for employees wishing to claim exemption from Pennsylvania Personal Income Tax. This guide will walk you through each step of filling out the form online, ensuring you understand what information is required and how to submit it correctly.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to access the Employees Statement Of Nonresidence In Pennsylvania Fillable Form. This will open the form in the designated editor to begin filling it out.

- Enter your full name in the Employee Name section, including your first name, middle initial (if applicable), and last name.

- Fill in your Social Security number accurately in the designated field. This information is essential for identification purposes.

- Provide your home address, including the city, state, and zip code. Make sure to use the correct format for state and zip code.

- Select your state of residence from the list provided (Indiana, Maryland, Ohio, New Jersey, Virginia, West Virginia). This is crucial as only these states have reciprocal agreements with Pennsylvania.

- Review your declaration statement regarding exemption from withholding of Pennsylvania Personal Income Tax, and ensure it reflects your true residence.

- Sign and date the form to validate your information. Your signature confirms that you are aware of the penalties of perjury.

- Provide your employer's name and their Federal Employer Identification Number (EIN) in the employer section. This data helps track the withholding exemptions.

- Complete the employer's business address and telephone number. Ensure all details are clear and accurate, as they are pivotal for communication.

- Once all fields are completed, make sure to review your entries for any errors. After ensuring accuracy, you can save changes, download, print, or share the completed form as required.

Get started filling out your form online today to ensure compliance and timely submission.

The PA-40 non-resident tax form is specifically designed for individuals who do not reside in Pennsylvania but have earned income from Pennsylvania sources. This form allows non-residents to report their income and calculate any tax liabilities. Accurate completion of this form is crucial for compliance with state tax laws. To simplify this, consider using the Employees Statement Of Nonresidence In Pennsylvania Fillable Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.