Loading

Get St101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St101 online

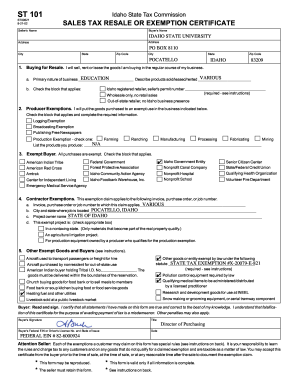

Filling out the St101 form is crucial for documenting sales tax exemptions or resale certificates in Idaho. This guide offers clear instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the St101 form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the seller's name and the buyer's name in their respective fields. Ensure that you provide correct and complete information.

- Input the addresses for both the seller and buyer, including the city, state, and zip code.

- In section 1, indicate whether you are buying for resale by checking the appropriate box. If applicable, describe the primary nature of your business and the products you sell, rent, or lease.

- For businesses buying for resale, input the Idaho seller's permit number. If you are an out-of-state retailer, make sure to check that option.

- Proceed to section 2 for producer exemptions. Check the box corresponding to the exemption that applies to your business and list the products you produce.

- In section 3, indicate whether you qualify as an exempt buyer by checking the appropriate block that applies, such as federal government or nonprofit organization.

- In section 4, provide the invoice, purchase order, or job number related to the exemption claim. Specify the city and state where the job is located, as well as the project owner's name.

- For section 5, check any other goods or entities exempt by law under the statute, providing necessary details where required.

- Finally, the buyer must read the certification statement, sign, and date the form. Include the buyer's title and federal EIN or driver’s license number.

- After completing the form, make sure to save your changes, download, print, or share the form as necessary.

Complete the St101 online to ensure your sales tax exemptions are properly documented.

To obtain a non-profit tax ID number, you must first apply for tax-exempt status with the IRS by completing Form 1023 or 1023-EZ, depending on your organization's size. After receiving approval, you can then request your Employer Identification Number (EIN), which serves as your non-profit's tax ID. Ensure that you keep your organizational documentation handy, as you may need to verify your non-profit status during the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.