Loading

Get Missouri 149 Form 10 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missouri 149 Form 10 2005 online

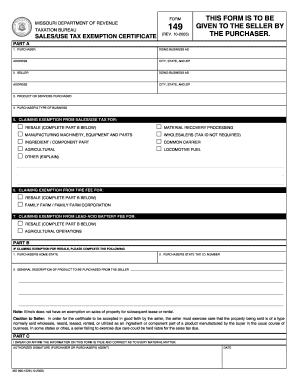

The Missouri 149 Form 10 2005 is essential for purchasers claiming exemption from sales and use tax. This guide will walk you through the process of completing this form online in a clear and supportive manner.

Follow the steps to fill out the Missouri 149 Form 10 2005 online.

- Click the ‘Get Form’ button to obtain the form and open it in an editor.

- In Part A, enter the purchaser's name, doing business as (DBA), address, city, state, and zip code.

- Complete the fields for the seller's name, DBA, address, city, state, and zip code.

- Provide a brief description of the products or services to be purchased.

- Describe the type of business conducted by the purchaser.

- Select the appropriate box to claim exemption from sales or use tax. If applicable, provide details about plant expansions, new plants, or design changes.

- If claiming an exemption for resale, move to Part B and fill out the purchaser's home state and state tax identification number.

- Provide a general description of the product to be purchased from the seller.

- In Part C, ensure to sign and date the form to verify the truthfulness of the information provided.

- Once completed, you can save your changes, download the form, print it, or share it as required.

Complete your Missouri 149 Form 10 2005 online for efficient processing and to ensure your tax exemption claim is managed properly.

Filling out Missouri Form 149, specifically the 2005 version, involves carefully following the instructions provided with the form. Ensure you input accurate information regarding your tax-exempt status and intended use of purchases. For assistance, leveraging platforms like uslegalforms can simplify the process, providing guidance to ensure you complete the form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.