Loading

Get How To Fill Out Real Estate Excise Tax Affidavit Controllling Interest Transfer Return Form Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the real estate excise tax affidavit controlling interest transfer return form online

This guide provides clear and supportive instructions for users on how to fill out the real estate excise tax affidavit controlling interest transfer return form. Following these steps will help ensure the accurate completion of the form for reporting transfers of controlling interest.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

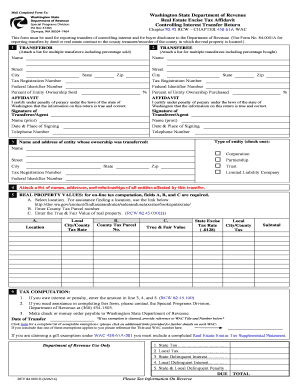

- Enter the information for all individuals or entities transferring interest in the designated section, including the name, address, tax registration number, federal identifier number, and percentage of entity ownership sold. If there are multiple transferors, attach a separate list.

- Fill in the transferee section similarly, providing all required details for individuals or entities receiving interest. Again, if there are multiple transferees, attach a list.

- Select the type of entity that is having its ownership transferred by checking the correct box (corporation, partnership, trust, or limited liability company). Also, include the name and address of the entity.

- Attach a detailed list of all entities affected by the transfer, specifying their names, addresses, and relationships to the transferred entity.

- Provide real property values by selecting the location, entering the county tax parcel number, and the true and fair value of the real property in the respective fields. These fields are required for online tax computation.

- Compute the taxes by calculating the state and local taxes and subtotaling the amounts. If applicable, indicate any interest or penalties owed.

- Enter the date of transfer in the indicated space to ensure timely payment of taxes to avoid penalties.

- If you are claiming a tax exemption, reference the appropriate WAC Title and Number in the space provided; ensure all claims comply with the requirements.

- Review all entries for accuracy, and then save changes, download, or print the completed form for submission.

Complete your real estate excise tax affidavit online today for efficient processing.

In Washington state, the seller of the property typically pays the real estate excise tax. However, the terms can vary based on the agreement between the buyer and seller. Understanding who is responsible for the tax is important when planning for real estate transactions, making it essential to know how to fill out real estate excise tax documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.