Get New York Tax Exempt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York Tax Exempt Form online

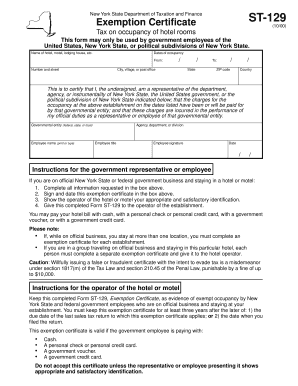

Filling out the New York Tax Exempt Form, officially known as Form ST-129, is a crucial step for government employees seeking exemption from hotel occupancy taxes while on official business. This guide provides clear, step-by-step instructions to assist users in completing the form online effectively.

Follow the steps to complete the New York Tax Exempt Form online.

- Click the ‘Get Form’ button to obtain the form and open it in the appropriate online editor.

- In the first section, provide the name of the hotel, motel, or lodging house where you will be staying. This information is essential for identifying the location of your occupancy.

- Enter the dates of your occupancy in the specified fields. Include both the start and end dates to confirm the duration of your stay.

- Fill in the complete address of the lodging, including the number and street, city or village, state, ZIP code, and country. This ensures accurate records for the exemption.

- Next, certify your status by indicating the government entity for which you are a representative. This can be a federal, state, or local government agency.

- Print or type your name in the designated field, and specify your agency, department, or division. This information confirms your official capacity.

- Provide your employee title in the respective area, followed by your signature to authorize the exemption. Don't forget to include the date of completion.

- Once all fields are completed, review the form carefully for accuracy. After verification, you may save the changes and choose to download, print, or share the form as needed.

Start completing your New York Tax Exempt Form online today to ensure a smooth experience during your stay.

To become exempt from sales tax in New York, you need to apply for an exemption certificate and submit the necessary forms, including the New York Tax Exempt Form. This process involves verifying your eligibility based on your organization's status or nature of the purchases. Using resources from US Legal Forms can help streamline this procedure and ensure you have all required documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.