Get Ma Sch 355u Name Of Principal Reporting Corporation At The Very Top Of The Page Is Blank In A 1120

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Sch 355u Name Of Principal Reporting Corporation At The Very Top Of The Page Is Blank In A 1120 online

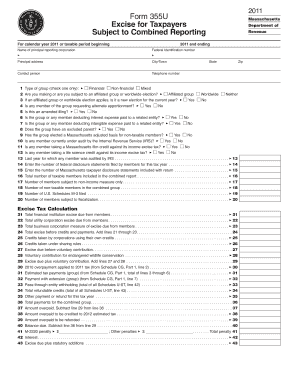

Filling out the Ma Sch 355u form online can seem challenging, especially when starting with a blank space for the name of the principal reporting corporation. This guide will provide you with clear and detailed steps to complete the form accurately, ensuring compliance with Massachusetts excise tax regulations.

Follow the steps to effectively fill out the form.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name of the principal reporting corporation in the designated field at the top of the page. Ensure that the name matches the legal name registered with the state.

- Fill in the federal identification number for the principal reporting corporation, which is essential for proper identification in tax filings.

- Provide the principal address, including the street, city or town, and state, to ensure correspondence can be accurately directed.

- Include the contact person for the corporation, along with a telephone number. This information is critical in case the Department of Revenue needs to clarify details regarding the filing.

- Check the appropriate box to indicate the type of group: Financial, Non-financial, or Mixed. This classification will affect how the excise is calculated.

- Respond to the affiliated group or worldwide election question by checking the relevant box. Make sure to determine if this represents a new election for the current year.

- Answer the subsequent questions regarding requests for alternate apportionment, amended filings, and any deductions for interest or intangible expenses paid to related entities.

- Continue filling out the rest of the form as directed, ensuring that all applicable fields are completed, including those regarding financial institution excise due from members.

- Once all sections are sufficiently filled out, review the information for accuracy and completeness.

- Save changes, and then select options to download, print, or share the form as required to fulfill your filing obligations.

Complete your Ma Sch 355u form online today for seamless compliance.

Related links form

A principal reporting corporation in Massachusetts refers to the main entity responsible for filing tax forms on behalf of a group or unitary business. This corporation must ensure that the Ma Sch 355u Name Of Principal Reporting Corporation At The Very Top Of The Page Is Blank In A 1120 is filled correctly to avoid any delays or complications. Essentially, this corporation represents the collective interests of the group and is accountable for providing accurate financial information to the state. By understanding this role, corporations can effectively manage their tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.