Loading

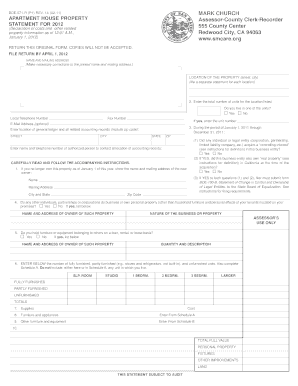

Get San Mateo Interactive Form 571 R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the San Mateo Interactive Form 571 R online

Filling out the San Mateo Interactive Form 571 R online can streamline the process of reporting your apartment house property statement. This guide provides a detailed, step-by-step approach to assist you in correctly completing and submitting the form.

Follow the steps to fill out the form accurately and efficiently.

- Click the 'Get Form' button to access the San Mateo Interactive Form 571 R and open it in your editor.

- Provide your name and mailing address, making any necessary corrections to the printed information. Ensure accuracy to prevent issues with processing.

- Enter the location of the property, including street and city. Remember to file a separate statement for each property location.

- Indicate the total number of units at the specified location. Also, specify if you reside in one of these units and provide the corresponding unit number if applicable.

- List the location of the general ledger and all relevant accounting records. Include the full address and the name and phone number of an authorized contact.

- If you no longer own the property as of January 1, list the new owner’s name and mailing address.

- Respond to the questions regarding any changes in control or ownership of the property. If applicable, additional forms may need to be submitted.

- Indicate whether other individuals or entities have personal property on your premises beyond household furniture. Provide details if the answer is yes.

- Specify if you hold furniture or equipment belonging to others. If so, include the owner’s details and descriptions of the items.

- Complete the sections about the number of furnished and unfurnished units, ensuring not to include any units where you live.

- Fill out Schedules A and B with the total cost of depreciable property as outlined. Be thorough and include all relevant financial details.

- Finalize your form by declaring the accuracy of your submissions and signing the declaration section. Without a signature, the form is not valid.

- After completing the form, you can save your changes, download it for your records, print it out, or share it with the necessary authorities.

Complete the San Mateo Interactive Form 571 R online today to ensure timely and accurate submission.

To access form 15CA, visit the California State Board of Equalization's website where all necessary tax forms are available for download. Alternatively, you can obtain the form directly from your county assessor's office. The San Mateo Interactive Form 571 R can be helpful for submitting related documentation and ensures you remain compliant with property tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.