Get Form #b 002 Calculation Of Potential Recapture Subsidy On Sale Of Home

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

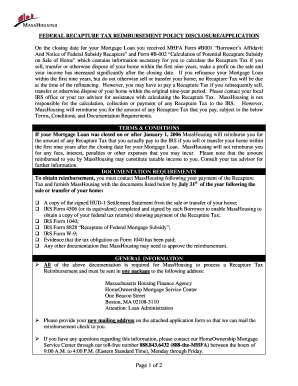

How to fill out the Form #b 002 Calculation Of Potential Recapture Subsidy On Sale Of Home online

Filling out the Form #b 002 is an essential step in documenting the potential recapture subsidy you may encounter when selling your home. This guide will help you navigate each section, ensuring that you complete the form accurately and efficiently. Follow the steps outlined below to successfully fill out this form online.

Follow the steps to fill out the Form #b 002 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the borrower's name in the designated fields. Ensure to include any suffixes such as Jr. or Sr. if applicable.

- Next, provide the Social Security Number for each borrower in the appropriate fields.

- Fill in the home phone, business phone, and cell phone numbers for each borrower, making sure to include the area code.

- Enter the loan number associated with your mortgage.

- In the 'MASSHOUSING MORTGAGE LOAN INFORMATION' section, input the property address, including street, city, state, and zip code.

- In the 'BORROWER/TAX PAYER MAILING ADDRESS' section, provide the new mailing address where the reimbursement check should be sent if the application is approved.

- Review the 'BORROWER/TAX PAYER ACKNOWLEDGMENT AND AGREEMENT' section, and ensure that each borrower understands the terms stated. Both borrowers should read this thoroughly before signing.

- Each borrower must sign and date the form in the space provided, confirming the accuracy and truthfulness of the information submitted.

- Once all fields are completed and signatures are obtained, users can save changes, download, print, or share the completed form.

Complete your Form #b 002 online today for efficient processing!

The 20% rule for capital gains tax refers to the maximum tax rate applied to long-term capital gains for higher-income taxpayers. This rate applies to gains from assets held for more than one year, including real estate. Knowing this can help you plan better when using tools like the Form #b 002 Calculation Of Potential Recapture Subsidy On Sale Of Home, as it takes tax implications into consideration.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.