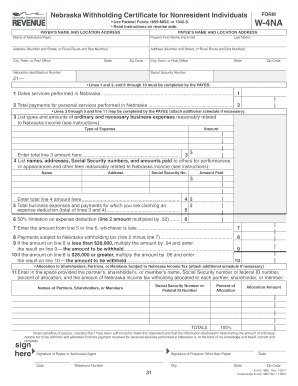

Get Form W 4na Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form W 4na Nebraska online

How to fill out and sign Form W 4na Nebraska online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Experience all the benefits of completing and submitting forms online. With our platform filling in Form W 4na Nebraska usually takes a few minutes. We make that achievable through giving you access to our feature-rich editor capable of altering/correcting a document?s original text, inserting unique boxes, and putting your signature on.

Complete Form W 4na Nebraska in just a few moments following the instructions listed below:

- Pick the document template you want from the collection of legal forms.

- Select the Get form button to open it and start editing.

- Complete the necessary fields (these are marked in yellow).

- The Signature Wizard will allow you to put your e-autograph after you?ve finished imputing details.

- Insert the relevant date.

- Double-check the entire template to make certain you have filled in all the information and no changes are required.

- Hit Done and download the resulting document to your device.

Send the new Form W 4na Nebraska in a digital form right after you finish completing it. Your data is well-protected, because we keep to the most up-to-date security criteria. Join numerous satisfied users who are already submitting legal documents right from their homes.

How to edit Form W 4na Nebraska: customize forms online

Put the right document management tools at your fingertips. Complete Form W 4na Nebraska with our trusted service that combines editing and eSignature functionality}.

If you want to execute and sign Form W 4na Nebraska online without hassle, then our online cloud-based option is the ideal solution. We provide a rich template-based library of ready-to-use forms you can modify and complete online. Furthermore, you don't need to print out the document or use third-party options to make it fillable. All the necessary tools will be readily available for your use once you open the document in the editor.

Let’s examine our online editing tools and their key functions. The editor features a self-explanatory interface, so it won't require much time to learn how to use it. We’ll check out three main parts that allow you to:

- Modify and annotate the template

- Arrange your documents

- Prepare them for sharing

The top toolbar has the tools that help you highlight and blackout text, without photos and image components (lines, arrows and checkmarks etc.), sign, initialize, date the document, and more.

Use the toolbar on the left if you wish to re-order the document or/and remove pages.

If you want to make the document fillable for other people and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

Aside from the capabilities mentioned above, you can shield your document with a password, add a watermark, convert the file to the required format, and much more.

Our editor makes modifying and certifying the Form W 4na Nebraska very simple. It allows you to make basically everything when it comes to working with documents. Moreover, we always ensure that your experience modifying documents is protected and compliant with the main regulatory criteria. All these aspects make utilizing our solution even more pleasant.

Get Form W 4na Nebraska, apply the necessary edits and changes, and download it in the desired file format. Give it a try today!

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $7,100$0.00Over $7,100 but not over $11,2702.26% of excess over $7,100Over $11,270 but not over $28,070$94.24 plus 3.22% of excess over $11,2704 more rows • 7 Mar 2022

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.