Get Form W 4na Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-4NA Nebraska online

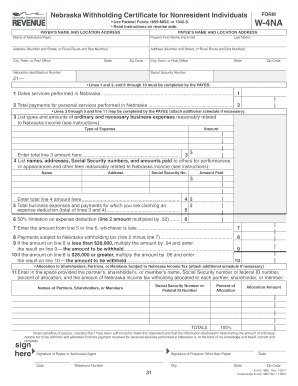

Filling out the Form W-4NA Nebraska accurately is essential for ensuring proper state income tax withholding for nonresident individuals providing personal services in Nebraska. This guide will walk you through the online process, making it straightforward and manageable for users of all skill levels.

Follow the steps to complete your Form W-4NA online

- Press the ‘Get Form’ button to access the Form W-4NA online and open it in your preferred editing tool.

- Fill in the payer’s name and address in the designated section, ensuring accuracy with their location details.

- Complete the payee’s information, including their name, address, and Social Security number, in the specific fields provided.

- In line 1, input the dates when the services were performed in Nebraska. Ensure this is precise for accurate tracking.

- Detail the total payments for personal services rendered in Nebraska on line 2. Include all related reimbursements.

- On lines 3 to 5, list any ordinary and necessary business expenses related to Nebraska income. Be detailed to avoid errors.

- Calculate the total of lines 3 and 4 on line 5 to determine total business expenses and other payments.

- Line 6 requires you to assess the 50% limitation on expense deductions by multiplying line 2 by 0.50.

- In line 7, determine the lesser amount between line 5 or line 6 to finalize the deduction.

- Proceed to line 8, where you will subtract the amount from line 7 from line 2 to find payments subject to withholding tax.

- For line 9, if the amount on line 8 is less than $28,000, multiply by 0.04; if $28,000 or greater, use line 10 instructions.

- After filling all necessary fields, review your information for accuracy. Once satisfied, you can proceed to save, download, or print the completed Form W-4NA.

Complete your Form W-4NA online today to ensure accurate withholding and avoid delays.

The best way to fill out Form W 4na Nebraska is to gather all necessary financial information beforehand. Be accurate with your income estimates and deductions to ensure proper withholding. Regularly review your W 4 to align it with any changes in your life circumstances, like marriage or a new job. Tools available on uslegalforms can further assist you in ensuring every detail is correct.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.