Loading

Get Form Rd 111

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Rd 111 online

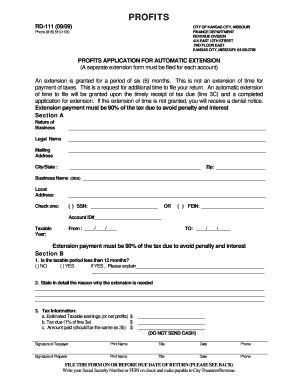

Filling out the Form Rd 111 online can streamline the process of applying for an automatic extension for your profits taxes. This guide provides clear and supportive instructions to help you accurately complete the form.

Follow the steps to successfully complete your Form Rd 111 online.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- In Section A, provide information about the nature of your business, legal name, mailing address, and business name (DBA). Ensure the city/state and zip code are accurately filled in.

- Check the appropriate box to indicate whether you have a Social Security Number (SSN) or a Federal Employer Identification Number (FEIN), and enter the corresponding number.

- Fill in your Account ID number and the taxable year dates to specify the period for which you are requesting an extension.

- Answer Section B questions by determining if the taxable period is less than 12 months and explaining the reason for the extension if applicable.

- Provide the tax information: calculate estimated taxable earnings or net profits, the tax due as 1% of that amount, and confirm the amount you have paid.

- Sign the form, print your name, title, and date, and provide a phone number. If applicable, a preparer should also sign and provide their details.

- Review all the information entered for accuracy before finalizing. You can then choose to save your changes, download the filled form, print it, or share it as needed.

Take the first step now by completing your Form Rd 111 online.

Filling out an income tax declaration involves compiling your income details, deductions, and any applicable credits. You may need to complete Form Rd 111 as part of your declaration process. Using platforms such as US Legal Forms can streamline this task by offering templates and guidance to help you fill out your declaration accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.