Loading

Get It Aff2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It Aff2 online

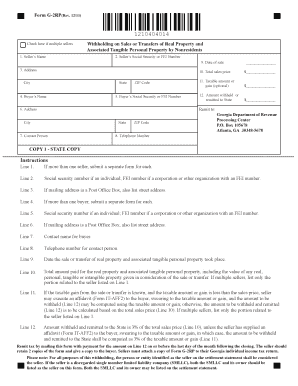

Filling out the It Aff2 form can be straightforward with the right guidance. This comprehensive guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the It Aff2 form correctly.

- Click the ‘Get Form’ button to access the document and open it for editing.

- Enter the seller's name in the designated field, ensuring accuracy since this information is crucial.

- Input the seller's Social Security number or Federal Employer Identification number as appropriate.

- Provide the seller's mailing address, including city, state, and ZIP code. If applicable, also include the street address for accurate processing.

- Fill in the buyer's name and repeat the entry of their Social Security or Federal Employer Identification number as necessary.

- Record the buyer's mailing address, ensuring to provide both the Post Office Box and street address if needed.

- Enter the name of the contact person for the buyer, along with their telephone number for follow-up.

- Input the date the sale or transfer occurred. Be sure to use the proper format.

- Specify the total sales price for the property and associated items, making sure to account for all components involved in the sale.

- If known, indicate the taxable amount or gain from the sale, ensuring it is less than the sales price. Use this information to determine the amount to be withheld.

- Calculate the amount to be withheld and remitted to the state as 3% of the total sales price, unless a different amount applies based on the taxable gain.

- Review all entries for accuracy and completeness before proceeding to submit or save the form.

Complete your documents online to ensure accuracy and efficiency.

Related links form

To fill an affidavit form, you should start by looking at a completed example to understand the necessary sections. Fill in your specific details, ensuring clarity and accuracy. Using It Aff2 allows you to view examples and templates that guide you through optimal completion of your affidavit forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.