Get Middle Tennessee State University Ein Number Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Middle Tennessee State University Ein Number Form online

Completing the Middle Tennessee State University Ein Number Form online is a straightforward process. This guide will provide you with detailed instructions to ensure that you fill out the form correctly and efficiently.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the document and open it for editing.

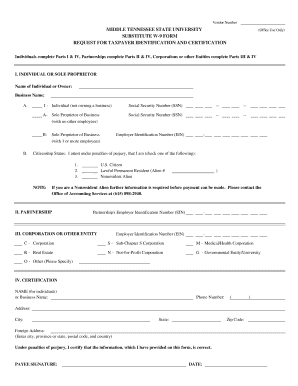

- Identify which part of the form you need to complete based on your status: Individuals complete Parts I & IV, Partnerships complete Parts II & IV, and Corporations or other Entities complete Parts III & IV.

- If you are an Individual or Sole Proprietor, fill in your name and, if applicable, your business name in Section I. Provide your Social Security Number (SSN) if you are not employing anyone.

- For Sole Proprietors who have one or more employees, enter your Employer Identification Number (EIN) in Section I-B.

- In Section I, indicate your citizenship status by checking the appropriate box for U.S. Citizen, Lawful Permanent Resident, or Nonresident Alien. If you select Nonresident Alien, note that further information is required, and you should contact the Office of Accounting Services.

- If you are filing as a Partnership, provide the Partnership's Employer Identification Number (EIN) in Section II.

- For Corporations or other Entities, complete Section III with the relevant Employer Identification Number (EIN), selecting the designation that applies to your entity.

- In Section IV, enter your name or business name, phone number, address, city, state, and zip code. If applicable, complete the foreign address section.

- Review all the information entered to ensure accuracy. Under penalties of perjury, you must certify that the information is correct by signing and dating the form.

- Once you have filled out the form, save your changes. You can then download, print, or share the completed document as needed.

Complete your forms online today for efficient processing and management.

No, MTSU is not classified as a 501(c)(3) organization. Instead, it operates as a public university and is funded through state appropriations, tuition, and fees. While it has tax-exempt status for certain transactions, its structure is different from that of private non-profit organizations. If you have specific inquiries regarding tax exemptions or need to submit the Middle Tennessee State University Ein Number Form, the university’s financial office can provide guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.