Loading

Get Imrf Federal Withhaoding Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Imrf Federal Withholding Forms online

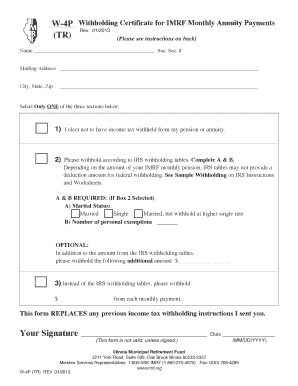

Filling out the Imrf Federal Withholding Forms correctly is essential for managing your income tax withholding from pension or annuity payments. This guide provides clear and concise instructions for completing the form online, ensuring you understand each section and its requirements.

Follow the steps to successfully complete the Imrf Federal Withholding Forms online.

- Press ‘Get Form’ button to obtain the form and open it for editing.

- Provide your name and social security number in the designated fields at the top of the form.

- Complete your mailing address by filling in the necessary fields for city, state, and zip code.

- Select only one option from the three sections provided concerning income tax withholding. Choose to either have no tax withheld, have tax withheld according to IRS tables (entering marital status and exemptions), or specify a fixed amount to be withheld.

- If applicable, complete sections A and B with your marital status and the number of personal exemptions.

- If you have selected the option to withhold an additional amount, enter that amount in the specified field.

- Review your entries for accuracy and ensure your selections align with your financial situation.

- Sign and date the form to validate it; remember that it is not valid without your signature.

- Once the form is complete, you can save changes, download the completed form, print it, or share it as required.

Complete your Imrf Federal Withholding Forms online today for efficient tax management.

You can find paper tax forms at local IRS offices, public libraries, and post offices. Additionally, many tax preparation services also provide these forms during tax season. To simplify your search and access all the necessary forms, including IMRF federal withholding forms, visit the US Legal Forms website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.