Get Ct 592

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 592 online

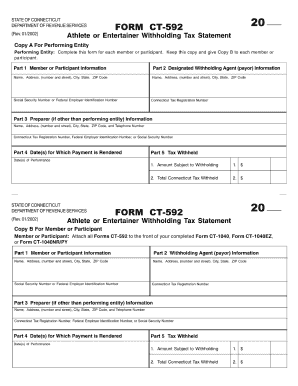

The Ct 592 is an important form used for reporting specific information. Completing this form accurately is essential to ensure compliance and proper processing. This guide will walk you through the steps to effectively fill out the Ct 592 online.

Follow the steps to complete the Ct 592 online without hassle.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Carefully read the form instructions and guidelines presented on the first page. Familiarizing yourself with the requirements will help ensure that you fill out the form correctly.

- Begin filling in the required information in the personal details section. Include your name, address, and contact information as requested.

- Proceed to the financial information section. Provide any necessary details regarding your income, deductions, and credits relevant to the filing.

- Review any additional sections that may require specific information based on your individual circumstances. Make sure to complete these fields as needed.

- Once all fields are completed, review the form thoroughly for any errors or omissions. Ensure that all information is accurate.

- Finally, you can save your changes, download the completed form, print a copy for your records, or share it as necessary.

Start filling out your Ct 592 online today to ensure timely and accurate compliance.

A tax return form allows individuals and businesses to report their income, expenses, and tax obligations for a specific period. It is essential for calculating the correct tax owed or any potential refund. The process of filing tax returns helps ensure that taxpayers remain compliant with tax laws. For assistance with completing your Ct 592 or any related forms, consider the comprehensive tools available at USLegalForms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.