Loading

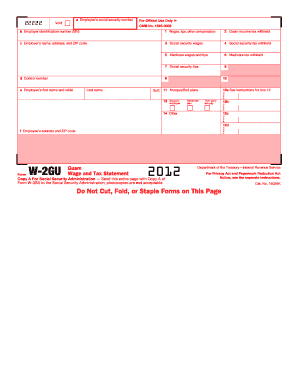

Get W 2gu Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 2gu Form online

This guide provides a comprehensive overview of the W 2gu Form, which serves as the Guam Wage and Tax Statement. Users will learn how to fill out the form accurately and efficiently online, ensuring all necessary details are recorded correctly.

Follow the steps to complete the W 2gu Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the employee's social security number in box 'a' and enter the correct number.

- In box 'b', provide the employer identification number (EIN).

- Fill in the employer's name, address, and ZIP code in box 'c'.

- Report wages, tips, and other compensation in box '1'.

- Enter the amount of Guam income tax withheld in box '2'.

- Include social security wages in box '3' and the social security tax withheld in box '4'.

- Provide the total Medicare wages and tips in box '5' along with the Medicare tax withheld in box '6'.

- Input social security tips in box '7' and any applicable control number in box 'd'.

- Input the employee's first name and initial along with their last name in box 'e'.

- Fill in the employee's address and ZIP code in box 'f'.

- Review and ensure all optional fields, boxes 10 through 14, are filled out correctly if applicable.

- Once all information is completed, you can save your changes, download, print, or share the form for your records.

Complete your W 2gu Form online today to ensure accurate filing.

When filing taxes with two W-2 forms, begin by entering the information from each form into your tax software systematically. Make sure to combine your total income when completing the tax return. If you need assistance, platforms like uslegalforms provide resources that can help you understand how to accurately report using your W 2gu Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.