Loading

Get Form 592 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 592 B online

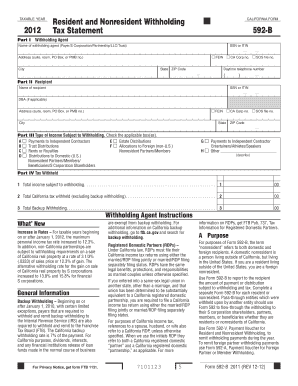

Filling out the Form 592 B online is essential for reporting withholding taxes related to income distributions. This guide provides clear and structured steps to help you successfully complete the form.

Follow the steps to fill out the Form 592 B online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the withholding agent's name and tax identification number, and complete the address details. Ensure your daytime telephone number is included for any follow-up queries.

- In Part II, fill in the recipient's name and tax identification number. If applicable, also include the Doing Business As (DBA) name, and provide the recipient's address.

- For Part III, check the applicable box or boxes for the type of income that is subject to withholding. This helps categorize the income being reported.

- In Part IV, calculate and fill in the total income subject to withholding on line 1. Enter the total California tax withheld on line 2, ensuring you're applying the correct withholding rates.

- Complete line 3 for any backup withholding amounts. Ensure all calculations are accurate to avoid potential errors.

- Review all entries thoroughly for completeness and accuracy. After ensuring that all fields are filled correctly, you can save changes, download, print, or share the completed form as needed.

Complete your documents online with confidence today!

Yes, California Form 592 can be filed electronically for efficiency and convenience. Many tax software options, including those provided by UsLegalForms, facilitate the electronic submission process. This can greatly enhance your filing experience, ensuring quicker processing times and less paper handling. Just ensure that you follow the guidelines set by the California Franchise Tax Board for a smooth submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.