Loading

Get Non-ad Valorem Certificate Of Correction Dr-409a - Okaloosa ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non-Ad Valorem Certificate Of Correction DR-409A - Okaloosa online

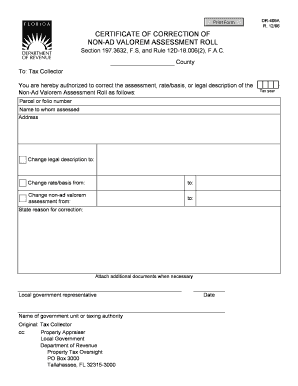

Completing the Non-Ad Valorem Certificate Of Correction DR-409A form is a critical process for correcting assessments on property. This guide provides straightforward, step-by-step instructions to help users navigate the online completion of this essential document.

Follow the steps to fill out your Non-Ad Valorem Certificate Of Correction DR-409A form accurately.

- Press the ‘Get Form’ button to access the Non-Ad Valorem Certificate Of Correction DR-409A form and open it for editing.

- Fill in the pertinent details regarding the property. Include the parcel or folio number, the name of the individual or entity to whom the property is assessed, and their address.

- Indicate the changes to be made in the legal description field. Clearly specify the old legal description and enter the new legal description.

- Specify the change in the assessment rate or basis. Record the previous rate/basis and enter the revised rate/basis in the designated fields.

- Document the adjustments in the non-ad valorem assessment. Provide the former assessment amount as well as the new assessment amount you are requesting.

- State the reason for correction in the specified area. This explanation helps clarify why the changes are necessary.

- If additional documentation is required to support your corrections, attach those files as instructed.

- Identify the local government representative or taxing authority responsible for the corrections by entering their name and the government unit.

- Finally, enter the date and specify the tax year relevant to the corrections being made.

- Once all revisions are complete, review the information for accuracy and proceed to save changes, download, print, or share your form as needed.

Start completing your Non-Ad Valorem Certificate Of Correction DR-409A online today!

In Florida, car registration fees consist of both ad valorem and non-ad valorem components. Only the ad valorem portion, which is based on your vehicle's value, can be considered tax deductible. Homeowners should track their vehicle's ad valorem fees for accurate reporting. The Non-Ad Valorem Certificate Of Correction DR-409A - Okaloosa can assist you in managing these details effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.