Loading

Get Form 1099 Misc Reminders For State & Local ... - In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FORM 1099 MISC REMINDERS FOR STATE & LOCAL GOVERNMENTS online

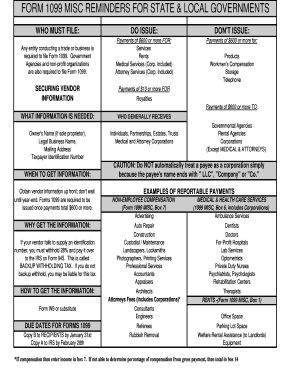

This guide provides a comprehensive overview of filling out the FORM 1099 MISC REMINDERS FOR STATE & LOCAL GOVERNMENTS online. It aims to assist users in understanding the steps involved in completing this form accurately.

Follow the steps to efficiently complete your FORM 1099 MISC online.

- Press the ‘Get Form’ button to access the FORM 1099 MISC. This will allow you to open the form in your browser or preferred document editor.

- Identify the requirements for filing. Ensure you have the necessary information, such as the owner’s name (if a sole proprietor), legal business name, mailing address, and taxpayer identification number.

- Specify the type of payments being reported. Payments of $600 or more must be categorized appropriately, such as for services, rents, medical services, or attorney services.

- Collect vendor information using Form W-9 or a substitute form to ensure you have the correct identification number for each payee.

- Complete any applicable sections on the form, ensuring that all required fields are filled in accurately, particularly focusing on reportable payments in the correct boxes.

- Review the completed form for accuracy. Double-check the dates, amounts, and identification numbers before finalizing your submission.

- Once verified, you can save your changes, download the completed form, or print it as necessary for distribution or record-keeping.

Complete your FORM 1099 MISC online today to ensure timely and accurate reporting!

Typically, you will receive a 1099-MISC form because you earned income that is considered miscellaneous by the IRS. This form is essential for documenting profits, acknowledging freelance work, or tracking other non-employee compensation. It is important to understand the nature of your income to manage your taxes effectively. Refer to FORM 1099 MISC REMINDERS FOR STATE & LOCAL ... - In for further guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.