Loading

Get Form 1104

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1104 online

Filling out the Form 1104 online can streamline your application process for the Employer Pull Notice Program. This guide provides clear, step-by-step instructions to help users accurately complete the form from the comfort of their home or office.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

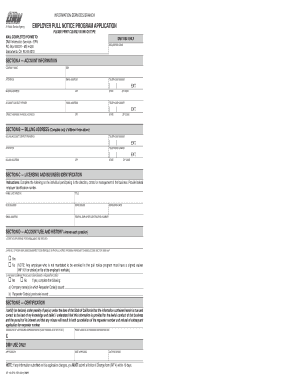

- Begin with Section A — Account Information. Enter your company name, doing business as (DBA) if applicable, and the attention contact person. Fill in the email address and telephone number, followed by the mailing address including city, state, and zip code. Finally, list the account contact person's name, email address, and telephone number, ensuring you include the physical street address.

- If your billing address is different from the account information provided, complete Section B — Billing Address. Include the billing account contact person's details, along with their telephone number and any relevant attention information. Fill in the billing address with the city, state, and zip code.

- In Section C — Licensing and Business Identification, provide the name, title, and driver's license or ID number of the individual managing the business. Include the state issued, email address, federal employer identification number, and expiration date.

- Proceed to Section D — Account Use and History. Clearly state your purpose for enrollment. Answer the mandatory enrollment question regarding your employees, noting that a signed waiver must be held for any non-mandated employees. If applicable, provide details regarding any previous requester codes issued to your company.

- Conclude with Section E — Certification. This section requires the signature of the authorized representative, who should also print their name. Ensure they sign to certify the accuracy of the information provided, understanding the consequences of any misrepresentation.

- After completing the form, you can save your changes, download a copy, print it, or share the form as needed.

Get started on filling out your Form 1104 online today!

Individuals and entities that hold foreign financial accounts must fill out a FATCA form. If your income exceeds a certain threshold, you are required to report it using Form 1104. This includes U.S. citizens, residents, and certain non-residents. Using platforms like uslegalforms can help you determine your reporting obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.