Loading

Get Ga Dept Of Revenue Att 15 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ga Dept Of Revenue Att 15 Form online

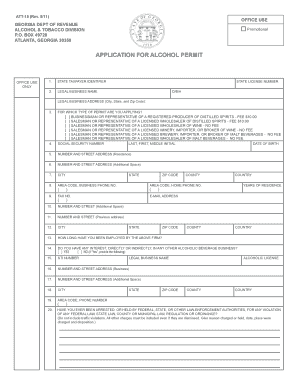

The Ga Dept Of Revenue Att 15 Form is essential for individuals seeking an alcohol permit in Georgia. This guide will help users navigate the process of filling out the form online efficiently and accurately.

Follow the steps to complete the Ga Dept Of Revenue Att 15 Form online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Enter your Georgia State Taxpayer Identifier in Line 1. If you do not have one, leave this field blank.

- In Line 2, fill in the name and address registered with the Secretary of State. If not registered, provide the name under which your business owns property or incurs debt.

- In Line 3, select the type of permit you are applying for by checking the appropriate box.

- For Lines 4 to 11, provide detailed information about the applicant, including Social Security Number, name, date of birth, home address, email, fax number, home telephone number, number of years at the current address, and previous home address.

- Line 12 requires you to enter your previous home address.

- In Line 13, indicate the number of years you have been employed by the company identified in Lines 1 and/or 2.

- Complete Line 14 by checking 'Yes' or 'No' based on whether you have any interest in any other alcoholic beverage business.

- If you answered 'Yes' in Line 14, provide details for each alcoholic beverage business in which you have an interest in Lines 15 to 19.

- In Line 20, disclose any previous involvement with government authorities.

- Line 21 requires you to provide your employment history from the past five years. Include the month and year employed, employer's name and address, and position held.

- Ensure that the application is signed and notarized as required.

- After filling out all necessary fields, save changes, and proceed to download, print, or share the form as needed.

Complete your Ga Dept Of Revenue Att 15 Form online today to ensure a smooth application process.

The 1040 form for a non-resident, specifically Form 1040-NR, is designed for individuals who do not pass the green card or substantial presence tests. This form is essential for accurately reporting U.S. income from non-residents. If you also have income from Georgia, remember to file the Ga Dept Of Revenue Att 15 Form for state tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.