Get St 8 Form Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 8 Form Ga online

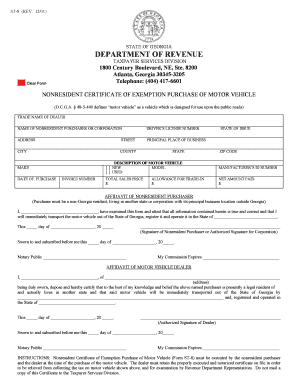

Filling out the St 8 Form Ga online can streamline your experience in obtaining a nonresident certificate of exemption for the purchase of a motor vehicle. This guide will offer clear and supportive instructions to assist users, regardless of their legal expertise.

Follow the steps to complete the St 8 Form Ga online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the trade name of the dealer in the designated field. This is essential to identify the vendor involved in the transaction.

- Next, provide the name of the nonresident purchaser or corporation. Ensure that the name corresponds with the entity that is buying the vehicle.

- Input the driver’s license number of the purchaser in the appropriate section. This serves as identification for verification.

- Fill in the address details, including street, city, county, state of issue, and zip code. It is important these details accurately reflect the purchaser's current residence.

- Enter the date of purchase, reflecting when the transaction occurs. Make sure this is the actual date of the sale.

- Complete the description of the motor vehicle by indicating whether it is new or used. Fill in the make, model, and manufacturer’s ID number.

- Next, provide the total sales price of the vehicle. This includes any applicable fees and taxes.

- Document the net amount paid by the purchaser. This may differ from the total sales price due to any negotiated discounts or allowances.

- If applicable, include any allowance for trade-in if another vehicle is being traded to reduce the total price.

- In the affidavit section, the nonresident purchaser must attest that all information is true. Ensure to sign and date the affidavit accurately.

- The dealer must also complete their affidavit section, confirming the purchaser's residency status and their dealership's involvement. Signing and dating are required.

- Once all portions are completed, save your changes. You may choose to download, print, or share the document as necessary.

Complete your St 8 Form Ga online today and ensure a smooth purchasing process.

To obtain a resale certificate in GA, complete the St 8 Form Ga, which is required for tax-exempt sales. You can download this form from the Georgia Department of Revenue’s website or request a copy from your local tax office. After filling out the form with the necessary details about your business and intended use, provide it to your vendors when making purchases. This process enables you to buy merchandise without incurring sales tax upfront.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.