Loading

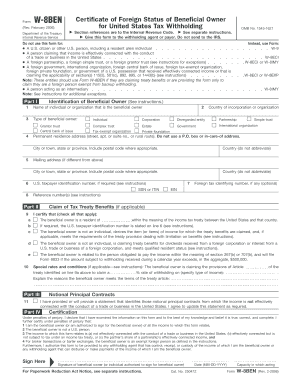

Get Form W 8ben Rev 02 2006 Omb No 1545 1621

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W 8ben Rev 02 2006 Omb No 1545 1621 online

Filling out Form W-8BEN is essential for foreign individuals and entities to certify their status for U.S. tax purposes. This guide provides a step-by-step approach to complete the form accurately online, ensuring compliance with withholding requirements.

Follow the steps to accurately complete the Form W 8ben Rev 02 2006 online.

- Click the ‘Get Form’ button to access the form, allowing you to open it in an editing interface.

- In Part I, fill in your name as the beneficial owner or the name of the organization if applicable. Additionally, specify the country of incorporation or organization.

- Select the type of beneficial owner from the list provided, such as individual, corporation, or partnership. Ensure to choose the most applicable option.

- Enter your permanent residence address, including street, city or town, state or province, and country. Avoid using a P.O. Box.

- If you have a mailing address different from the permanent address, fill in the details accordingly.

- Provide your U.S. taxpayer identification number if required. This could be a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, include your foreign tax identifying number and any reference numbers as noted in the instructions.

- In Part II, check all boxes that apply to certify eligibility for tax treaty benefits or other relevant conditions mentioned.

- Outline the special rates or conditions, if claiming a reduced withholding rate under a tax treaty, and provide an explanation supporting your claim.

- In Part III, state your intentions regarding notional principal contracts and your commitment to provide necessary updates.

- Complete Part IV by signing and dating the form. Ensure that the signature is from the beneficial owner or an authorized person.

- Finally, review the filled-out form for accuracy. Save your changes, then download, print, or share the document as needed.

Complete your Form W-8BEN online today to ensure compliance with U.S. tax regulations.

Related links form

8BEN form is a document used by nonU.S. persons to certify their foreign status for tax purposes regarding income received from U.S. sources. Completing this form is essential for minimizing potential tax withholding. By using the Form W8BEN Rev 02 2006 Omb No 1545 1621, you help ensure compliance with U.S. tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.