Get I Am A Homebuyer, Applying For 1st Home Financial Assistance - Downpayment And Closing Costs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the I Am A Homebuyer, Applying For 1st Home Financial Assistance - Downpayment And Closing Costs online

Completing the form 'I Am A Homebuyer, Applying For 1st Home Financial Assistance - Downpayment And Closing Costs' is a crucial step towards securing financial aid for your first home purchase. This guide provides easy-to-follow steps to assist you in accurately filling out the form online.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

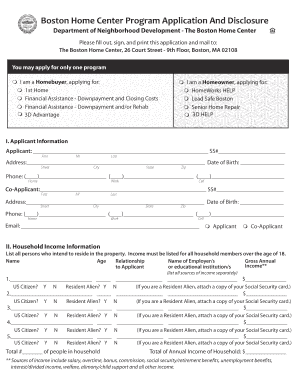

- Begin by entering your applicant information. Fill out the applicant's name, social security number, address, date of birth, and various phone numbers (home, work, and cell). If applicable, also provide the co-applicant's details.

- Proceed to the household income information section. List everyone residing in the household over the age of 18, their age, relationship to the applicant, name of employer or educational institution, and gross annual income. Ensure to indicate if each person is a U.S. citizen or a resident alien as required.

- In the household asset information section, disclose all current values of your assets, including savings, expected income from dividends, and deposits made on the property. Complete all fields, even if the answer is zero, and ensure to sum up your assets.

- Next, provide information about the subject property. Include the address and type of property being purchased. Answer questions regarding repairs needed and if the property requires de-leading. If applicable, mention any minor children and the nature of their presence in the property.

- If renting, complete the rental unit information with details of the property address and tenant information as applicable.

- Then, complete the other required financial information section. Indicate whether you have received financial assistance in the past from the City of Boston and provide any relevant details.

- In the affirmative marketing section, disclose your race/ethnicity voluntarily and how you learned about the program, ensuring that this section is filled out to assist with compliance.

- Finally, review all the information entered for completeness and accuracy, then sign and date the application, both for the applicant and co-applicant if applicable. Make sure to keep a copy for your records.

- Once completed, save your changes, then download, print, or share the form as necessary for submission.

Take the time to complete your documents online today and step toward your future home.

In general, closing costs cannot be included in your down payment when I am a homebuyer applying for 1st home financial assistance for downpayment and closing costs. The down payment must be sourced from your own funds or acceptable gift funds, distinct from the fees incurred at closing. However, various programs may offer assistance that can help alleviate the burden of both costs. To explore these options and find the best route for your situation, consider utilizing tools available through USLegalForms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.