Loading

Get Form 433 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433 A online

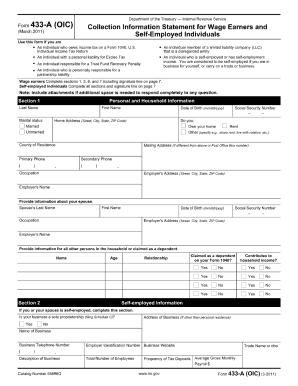

Filling out Form 433 A online can be a straightforward process when you understand each component. This guide will provide detailed steps to help you complete the form efficiently and accurately.

Follow the steps to successfully complete your Form 433 A.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out your personal information in the designated fields. This typically includes your full name, social security number, and contact information. Ensure all entries are accurate and up to date.

- Next, provide information about your financial assets, including bank accounts and other monetary holdings. You may need to specify account balances and types accordingly.

- Fill in the details regarding your income sources. Be sure to include all relevant income streams, such as wages, self-employment earnings, and any other consistent revenue.

- Document your monthly expenses in the appropriate section. List all fixed and variable costs such as housing, utilities, and transportation to give a clear picture of your financial obligations.

- After inputting all required information, review the completed form for accuracy. Make any necessary edits to ensure that all fields are filled out correctly.

- Once satisfied with the accuracy of your entries, you can save changes, download, print, or share the form as needed.

Start completing your Form 433 A online today.

Form 433 A requires you to fill out various sections detailing your personal information, income sources, and monthly expenses. You will need to provide information about your assets, including bank accounts, real estate, and vehicles. Each section plays a vital role in helping the IRS understand your financial capacity. For detailed help and templates, check out uslegalforms, where you can find expertly crafted resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.