Loading

Get Form Tax020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Tax020 online

Filling out the Form Tax020, the employer's quarterly unemployment insurance tax report, is essential for maintaining compliance with state regulations. This guide provides a clear, step-by-step process tailored to help users accurately complete the form online.

Follow the steps to successfully complete Form Tax020 online

- Click 'Get Form' button to obtain the form and open it in the editor.

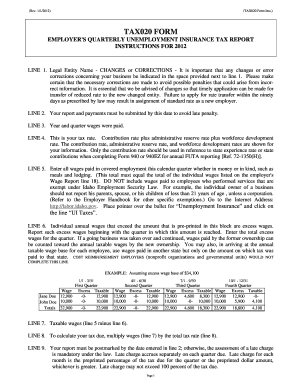

- In line 1, enter the legal entity name. If there are changes or corrections to your business name, be sure to indicate these clearly to avoid penalties.

- Input the submission date in line 2 to ensure timely payment and avoid any late penalties.

- Provide the year and quarter when wages were paid in line 3.

- Review and input the tax rate in line 4, which includes the contribution rate, administrative reserve rate, and workforce development rate. Only the contribution rate is used for annual FUTA reporting.

- In line 5, enter all wages paid in covered employment during the calendar quarter, ensuring this total matches the wages reported on the employer's Wage Report.

- For line 6, report any annual wages that exceed the pre-printed amount, identifying these as excess wages.

- Calculate taxable wages in line 7 by subtracting the excess wages reported in line 6 from the total wages in line 5.

- Multiply the taxable wages from line 7 by the total tax rate (line 8) to determine the amount of tax due.

- In line 9, ensure the report is postmarked by the indicated date to avoid any late charges.

- Calculate the total amount due for the quarter by adding the tax due (line 8) and any late charges (line 9) in line 10.

- If applicable, enter any balances from previous quarters in line 11 and calculate the total due in line 12.

- Report the monthly employment data for all full-time and part-time workers in line 13, ensuring no months are left blank.

- Finally, review your form for accuracy, and once completed, you can save changes, download, or print the form for submission.

Complete your documents online today to ensure compliance and avoid penalties.

The best way to file the FBAR is through the BSA E-Filing System, as it simplifies the process significantly. Utilizing Form Tax020 can help you understand what information is needed and how to complete your submission properly. It’s crucial to follow the instructions carefully to ensure compliance. Additionally, file it promptly to avoid any issues with late submissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.