Loading

Get F1040se 2006 Form - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F1040se 2006 Form - Irs online

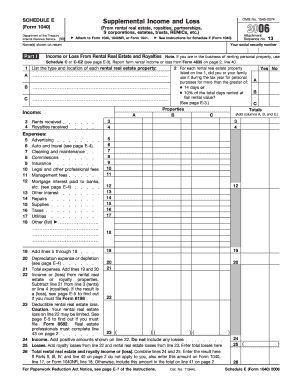

This guide provides comprehensive instructions for completing the F1040se 2006 Form online. By following these steps, users can efficiently fill out and submit their form, ensuring compliance with IRS requirements related to supplemental income and loss.

Follow the steps to complete the F1040se 2006 Form online

- Click ‘Get Form’ button to obtain the form and open it in your browser or PDF editor.

- Begin by entering your name(s) as shown on your tax return along with your social security number. Pay careful attention to ensure accuracy here as this information is crucial.

- In Part I, list the type and location of each rental real estate property you own, filling in columns A, B, and C as needed.

- In the income section, provide the total rents received and royalties received from these properties. Ensure these figures are accurate and add up all sources of income.

- Determine if you or your family used the listed properties for personal purposes during the tax year. Mark ‘Yes’ or ‘No’ for each property based on the criteria provided.

- In the expenses section, detail each expense related to the rental properties. This includes advertising, maintenance, insurance, and others listed. Fill out lines 5 through 18 with the appropriate amounts.

- Calculate total expenses by adding the amounts from lines 5 to 18, as well as depreciation or depletion listed on line 20.

- Subtract total expenses from total rents received or royalties to determine income or loss from rental properties. This figure will inform if you have a deductible rental real estate loss.

- Complete Parts II through IV if they apply to your situation. Report any income or loss from partnerships, S corporations, estates, or trusts, following the detailed guidance provided in these sections.

- Finally, review all entries for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as needed.

Complete your forms online to ensure a streamlined filing process.

Yes, there is a distinct difference between the 1040 form and the 1040-ES form. The 1040 form is your annual income tax return, while the 1040-ES form is specifically for making estimated tax payments throughout the year. Understanding this difference is key, and leveraging the F1040se 2006 Form - IRS can assist you in managing your tax filings and payments efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.