Loading

Get Fidelity Charitable Grant Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Charitable Grant Application online

Filling out the Fidelity Charitable Grant Application online is a straightforward process designed to support users in recommending grants effectively. This guide provides step-by-step instructions to ensure the application is completed accurately and efficiently.

Follow the steps to complete your grant application with ease.

- Click ‘Get Form’ button to access the Fidelity Charitable Grant Application. This will open the document in your preferred editing tool.

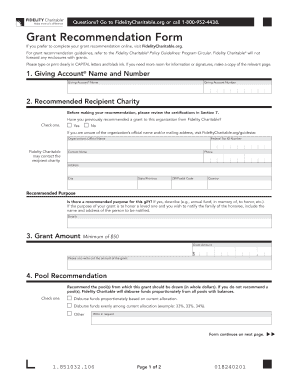

- Begin by entering your Giving Account® name and number. This information is essential for identifying your account and processing the grant successfully.

- Provide the recommended recipient charity's details. Confirm if you have previously recommended a grant to this organization and enter its official name, federal tax ID number, and contact information.

- Indicate the recommended purpose for your grant. If applicable, include any additional details such as names and addresses of individuals you wish to notify.

- Specify the grant amount, ensuring it meets the minimum requirement of $50. Write out the amount in words as well as numerically.

- Choose the pool recommendation for disbursing funds or select the option for Fidelity Charitable to disburse funds proportionately.

- Select how you would like to be acknowledged for the grant, either as an individual, anonymously, or using another person's name.

- Indicate the timing for your grant, specifying if it should be issued as soon as possible, on a specific date, or on a recurring basis. Provide the required frequency and start/end dates.

- Review the signature section. You need to certify several conditions related to the grant. Sign and date the form, ensuring your details are accurate.

- After completing the form, save your changes. You may then download, print, or share the document as needed before submitting it.

Start your grant application process online today and make a difference!

When you receive a check from Fidelity, write your account number on the back. This ensures that the funds are correctly allocated. Additionally, you might want to include any reference information that can help with tracking. For precise guidance on your Fidelity Charitable Grant Application, check US Legal forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.