Loading

Get Mesa City Tax For Sole Proprietors Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mesa City Tax for Sole Proprietors form online

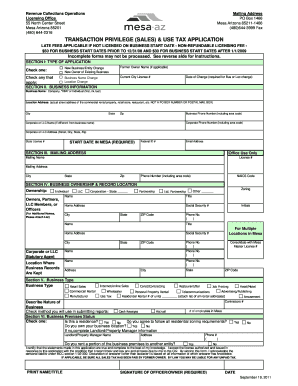

Filling out the Mesa City Tax for Sole Proprietors form online is an essential step for individuals and owners of businesses in Mesa. This guide will provide you with clear instructions on how to complete each section of the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your business information in Section II. Include your business name, location address, and contact information. Ensure to use the actual location where your business operates, not a PO Box.

- In Section III, fill out the mailing address. This address will be used for correspondence related to your tax license.

- Proceed to Section IV where you will indicate the type of ownership. Provide the required details for all owners, partners, or members involved in the business.

- Continue to Section V to specify the type of business activities you will be conducting. Choose from the options presented and provide a detailed description of your business activities.

- If applicable, complete Section VI regarding the status of your business premises. Indicate whether you own or rent your business location and provide landlord details if necessary.

- Review all sections for accuracy and completeness. Ensure that you have included any required attachments and that your form is signed appropriately.

- Finally, save your changes, and download, print, or share the completed form as needed.

Complete your application forms online to ensure a smooth licensing process.

Related links form

You can obtain Arizona tax forms at several locations, including local Department of Revenue offices and online through the Arizona Department of Revenue website. Many federal and state tax forms are also available for download. For sole proprietors, the Mesa City Tax for Sole Proprietors Form is crucial, so ensure you have the latest version when filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.