Get Deferred Compensation Agreement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deferred Compensation Agreement Form online

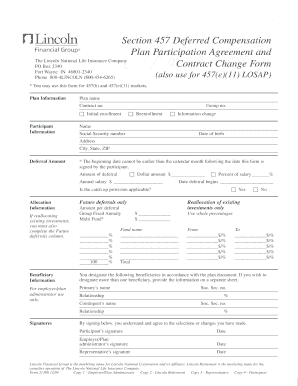

Filling out the Deferred Compensation Agreement Form online can seem daunting, but this guide will walk you through each step to ensure you complete the process smoothly and accurately. Whether you are enrolling for the first time or making changes to your existing arrangements, follow these clear instructions to get started.

Follow the steps to fill out the Deferred Compensation Agreement Form online

- Click ‘Get Form’ button to obtain the Deferred Compensation Agreement Form and open it in your chosen editor.

- Enter the plan information in the designated fields, including the plan name, contract number, and group number.

- Indicate whether this is an initial enrollment, reenrollment, or an information change by selecting the appropriate option.

- Provide your personal details, including your name, social security number, date of birth, and address. Ensure each field is completed accurately.

- Specify the amount you wish to defer by filling in the deferral amount field. Remember that the deferral starting date cannot be earlier than the following calendar month after you sign the form.

- If applicable, indicate whether the catch-up provision applies to your deferral by selecting 'Yes' or 'No'.

- Complete the allocation information section. If you are reallocating existing investments, ensure to fill in both the future deferrals and current allocations as required.

- Designate your beneficiaries by listing their names and relationships. If you have more than one beneficiary, provide additional information on a separate sheet.

- Finally, review all of the information provided for accuracy. Then, proceed to sign the form where indicated, including the participant's, employer/plan administrator's, and any representative signatures.

- Save your completed changes, then download, print, or share the form as necessary.

Start filling out your Deferred Compensation Agreement Form online today!

Deferred compensation is commonly reported on your W-2 form, specifically in the boxes designated for nonqualified plans. Employers must report earnings, contributions, and distributions as determined by IRS regulations. It is crucial to ensure that your Deferred Compensation Agreement Form aligns with reporting requirements to maintain compliance. For more assistance with these forms, uslegalforms offers resources to guide you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.