Loading

Get Ptea1099 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptea1099 Form online

Filling out the Ptea1099 Form online is a straightforward process that can help you apply for various tax exemptions efficiently. This guide outlines each step you need to take to complete the form accurately and submit it in a timely manner.

Follow the steps to complete the Ptea1099 Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

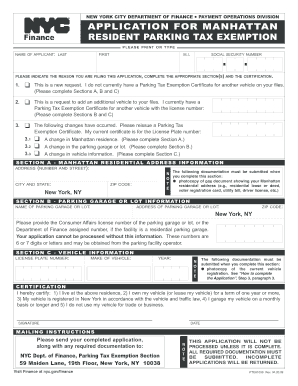

- Begin by entering your name in the designated fields. Please ensure you print or type your last name, first name, and middle initial.

- Provide your social security number in the specified field to ensure accurate identification for your application.

- Indicate the reason for filing the application by checking the appropriate box. You may need to select from options such as 'new request', 'additional vehicle', or 'changes to an existing vehicle'.

- Complete Section A with your Manhattan residential address. Ensure you submit a photocopy of a document verifying your residency, like a lease or utility bill.

- Fill out Section B with the name and address of the parking garage or lot you intend to use. Include the Consumer Affairs license number provided by the parking facility operator.

- In Section C, enter details about your vehicle, including the license plate number, make, and year. Upload a photocopy of your current vehicle registration to validate this information.

- Sign and date the certification section to attest that all provided information is accurate and complete.

- Finally, ensure all required documentation is attached, and submit your completed application through the specified mailing instructions.

Start filling out your documents online today!

Related links form

To submit your 1099, ensure you prepare the Ptea1099 Form accurately and send it to the appropriate tax authorities. You can file electronically or by mail, depending on your preference and the volume of forms you are submitting. For a smoother experience, consider using platforms like US Legal Forms, which simplify the submission process and provide clear instructions. Always keep a copy for your records to maintain proper documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.