Loading

Get Mi 1040x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi 1040x online

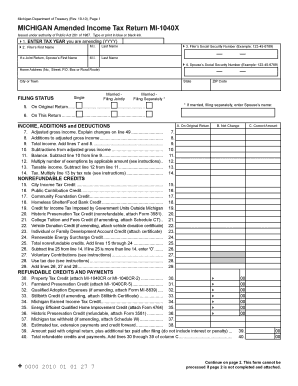

The Mi 1040x is the Amended Income Tax Return for Michigan, allowing users to correct errors on their previous tax filings. This guide provides clear, step-by-step instructions to help users complete the form online accurately.

Follow the steps to complete the Mi 1040x online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year you are amending in field 41 (YYYY format). Ensure this is accurate, as the processing of your return depends on it.

- Fill in the filer’s last name and first name in fields 42 and 43, including the spouse's details if applicable.

- Provide the social security numbers for both the filer and spouse in fields 43 and 44.

- Input your home address, city or town, state, and ZIP code in the designated fields, ensuring all information is correct.

- Select your filing status among the options provided, including single, married filing jointly, or married filing separately.

- Complete the income and deductions sections by entering the corresponding figures from your original return and any necessary changes in columns provided (A, B, and C).

- List any applicable credits in the nonrefundable and refundable credits sections, adding the amounts as necessary. Attach any required documentation for specific credits.

- Review the total nonrefundable credits and payments. Ensure all lines are accounted for and correctly calculated.

- Check the residency status section, and if applicable, fill in the dates of Michigan residency for part-year residents.

- If changing exemptions, complete the exemptions section by entering numbers as required and providing details for any dependents.

- In the explanations of changes section, clearly outline the reasons for any amendments being made to income, deductions, or credits.

- Sign and date the form in the designated areas, ensuring compliance with the certification requirements.

- Once all fields are complete, save your changes, and download or print the form as needed for submission.

Begin your online filing for the Mi 1040x today to ensure your tax amendments are processed smoothly.

Yes, you can amend your tax return even after you have filed. To do this, simply complete the MI 1040X form to reflect any necessary changes. It is important to file your amendment as soon as you notice an error, as timely corrections can help you avoid potential penalties. Using resources like USLegalForms can further streamline the amendment process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.