Loading

Get Mi W4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi W4 Form online

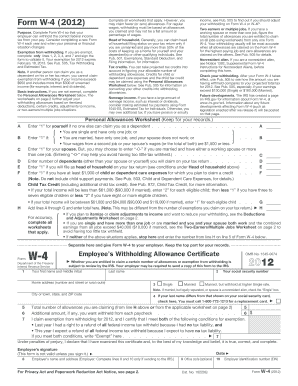

The Mi W4 Form is essential for ensuring that the correct amount of Michigan income tax is withheld from your paycheck. Completing this form online can simplify the process and help you manage your tax withholdings effectively.

Follow the steps to successfully fill out the Mi W4 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security Number in the designated field.

- Provide your full name by typing your first name, middle initial, and last name.

- Input your home address, including the street number, city, state, and ZIP code.

- Indicate whether you are a new employee by selecting 'Yes' or 'No' and, if applicable, enter your date of hire.

- Clearly state the number of personal and dependent exemptions you are claiming.

- If you wish to have an additional amount withheld from each pay, specify that amount here.

- Claim exemption from withholding by providing the relevant reason, if applicable, and provide any necessary explanations.

- Sign and date the form to validate your information.

- Save your changes, download a copy of the form, and print it for your records. Submit the completed form to your employer.

Ready to manage your tax withholdings? Complete your Mi W4 Form online today!

You can access MI tax forms on the Michigan Department of Treasury's website, where a wealth of resources is available for taxpayers. Furthermore, platforms like US Legal Forms offer easy access to a variety of tax documents, including the MI W4 Form. This ensures you have everything you need to stay compliant and file accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.