Get 2007 Schedule B Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Schedule B Form online

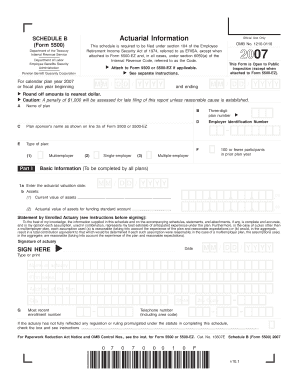

Filling out the 2007 Schedule B Form correctly is essential for compliance with federal regulations under ERISA. This guide provides clear instructions to assist you in completing the form online in an efficient manner.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to access the 2007 Schedule B Form and open it in your preferred editor.

- Provide basic information in Section A. Enter the name of the plan, the Employer Identification Number (EIN), and the plan sponsor's name exactly as shown on Form 5500 or 5500-EZ.

- In Part I, fill in the actuarial valuation date as indicated. Next, complete the asset information fields, including current value and actuarial value of assets.

- Sign the statement by the enrolled actuary, ensuring your signature and date are entered. Include your name, firm name, address, and contact information.

- Enter operational information as of the beginning of the plan year, including current value of assets and the 'RPA '94' current liability.

- Fill in the contributions made to the plan for the plan year by employers and employees with the required month, day, year, and amounts.

- Complete the actuarial cost method used and indicate if any changes in funding methods were made this year. Follow instructions for any additional information required.

- Review the checklist of actuarial assumptions, entering relevant percentages and rates for interest, mortality tables, expected investment returns, and actuarial assumptions.

- Lastly, ensure all totals and necessary calculations are correct before saving your work. You can then download, print, or share the completed form as needed.

Take action now by completing your 2007 Schedule B Form online to ensure compliance with reporting requirements.

The Schedule B form is crucial for reporting interest and dividend income, which is mandatory for certain taxpayers. By accurately completing this form, you ensure you're compliant with IRS regulations. Moreover, the details included on your Schedule B can influence your overall tax liability. If you're filing taxes for previous years, such as 2007, the 2007 Schedule B Form will specifically help clarify those requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.