Loading

Get Irs F1040sc 2007

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs F1040sc 2007 online

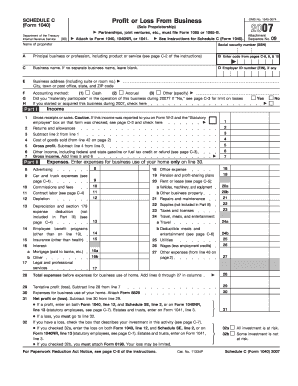

Filling out the Irs F1040sc 2007 form is essential for reporting profit or loss from business activities. This guide provides clear step-by-step instructions to help you complete the form online efficiently and accurately.

Follow the steps to complete your Irs F1040sc 2007 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as the proprietor and provide your social security number (SSN) in the designated fields.

- Indicate your principal business or profession, including the type of product or service you provide. Look for the appropriate code from the referenced pages and enter it next.

- If applicable, enter your employer identification number (EIN) and the complete business address, including suite or room number.

- Select your accounting method: cash, accrual, or other, and confirm if you materially participated in the operation of your business during the year.

- Complete Part I by entering your gross receipts or sales, subtract costs of goods sold, and calculate gross profit.

- Fill in the expenses section by listing each business expense, including advertising, car expenses, utilities, and more, ensuring accuracy as you tally your total expenses.

- Calculate your net profit or loss by subtracting total expenses from your gross income.

- If you incurred a loss, complete Part II by checking the appropriate box that describes your investment in the activity.

- Finalize your form by reviewing all entries for accuracy and completeness. Save changes, download, print, or share the completed form as needed.

Complete your Irs F1040sc 2007 form online today to ensure accurate reporting of your business profits or losses.

Schedule C allows you to report various types of income, primarily the income generated from your sole proprietorship or freelance work. This includes earnings from sales, services provided, and any business-related income that is not reported elsewhere. Reporting all relevant income on your IRS F1040sc 2007 is crucial for accurate tax calculation and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.