Loading

Get Form It 201 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-201 2007 online

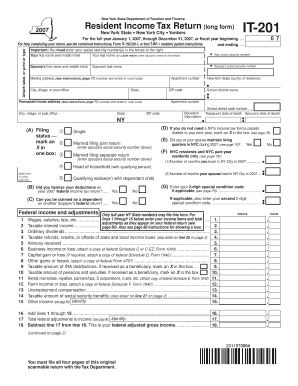

Filling out the Form IT-201 for the 2007 tax year can be simplified with a clear understanding of its components. This guide provides a step-by-step approach to complete the form accurately and efficiently online.

Follow the steps to successfully complete the Form IT-201 2007 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your personal information in the designated fields, including your first and last name, social security number, and mailing address. Make sure to accurately provide your partner's information if filing jointly.

- Select your filing status by marking an X in the appropriate box. This includes options such as Single, Married filing jointly, or Head of household.

- Provide details concerning your income by entering data in the relevant sections of the form. This may include wages, tips, and other income sources as specified in the instruction guide.

- Complete the section regarding New York additions and subtractions, ensuring that all amounts are accurately calculated and appropriately entered.

- Fill out the section for deductions, where you can choose between standard deductions or itemized deductions, marking the correct option in the form.

- Follow through with tax computations and credits, entering relevant details as required by the form, including the amount owed or refunded.

- Finally, review all entered information for accuracy and completeness. Once confirmed, save your changes, download your completed form, or print it for submission.

Start filling out your Form IT-201 2007 online today for a successful tax preparation experience.

If you receive a tax notice from New York State, carefully review the notice for specific instructions on how to respond. It's essential to gather relevant documentation and ensure your tax return is accurate, including considerations from Form IT-201 2007. If you need help, consulting a tax professional can provide clarity and guidance in resolving any issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.